Obtain the Right Fit: Medicare Supplement Plans Near Me

Obtain the Right Fit: Medicare Supplement Plans Near Me

Blog Article

How Medicare Supplement Can Boost Your Insurance Coverage Insurance Coverage Today

In today's complicated landscape of insurance policy choices, the duty of Medicare supplements stands apart as an essential element in boosting one's coverage. As people navigate the complexities of medical care plans and look for thorough protection, recognizing the nuances of additional insurance policy becomes progressively vital. With a focus on connecting the voids left by traditional Medicare plans, these supplementary options provide a customized strategy to meeting particular requirements. By discovering the benefits, coverage choices, and expense factors to consider related to Medicare supplements, individuals can make informed decisions that not just strengthen their insurance coverage however likewise provide a sense of safety and security for the future.

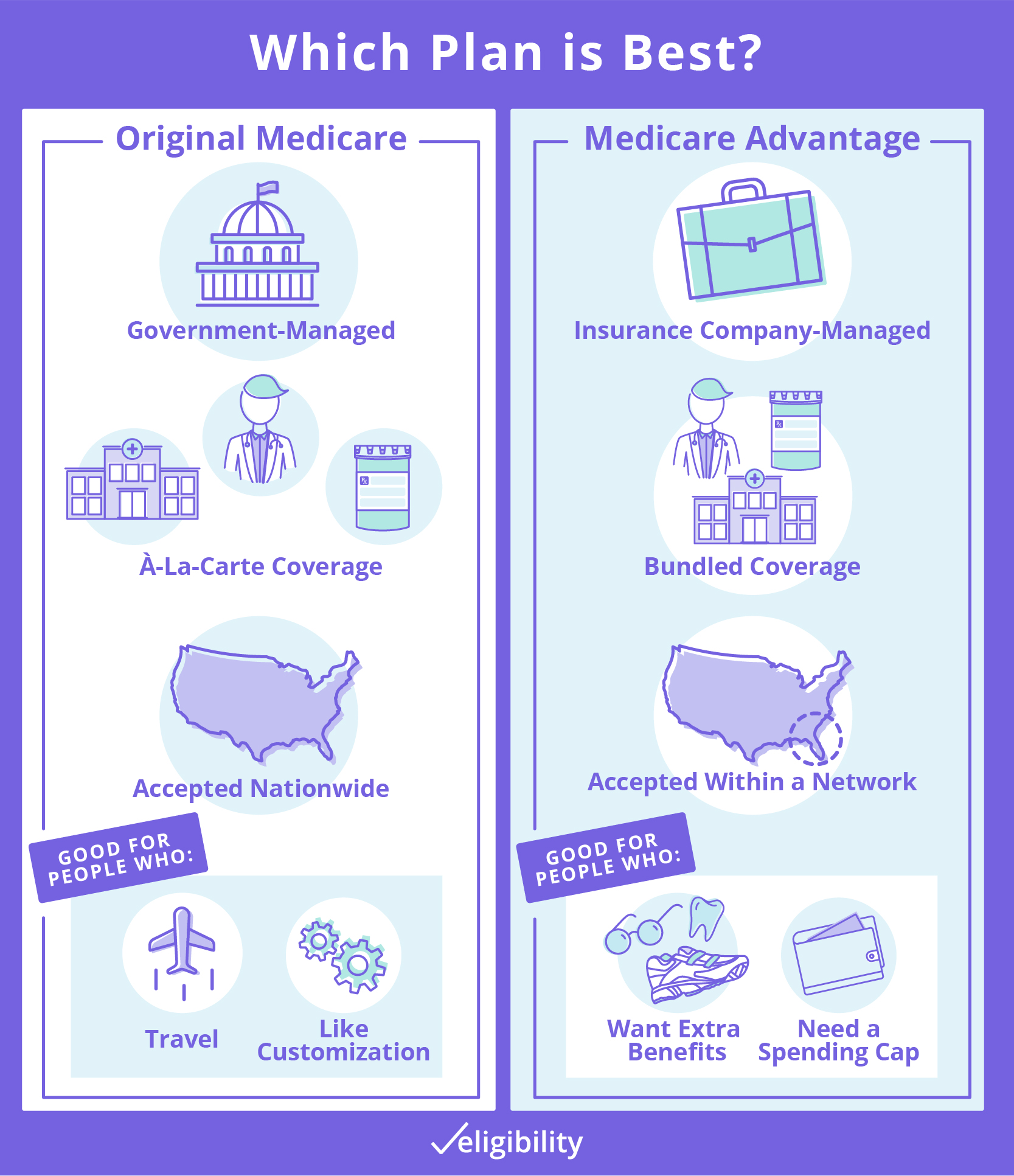

The Fundamentals of Medicare Supplements

Medicare supplements, additionally referred to as Medigap plans, give additional protection to load the voids left by original Medicare. These extra strategies are offered by personal insurer and are developed to cover expenses such as copayments, coinsurance, and deductibles that are not completely covered by Medicare Component A and Component B. It's important to note that Medigap plans can not be utilized as standalone plans yet job alongside original Medicare.

One key element of Medicare supplements is that they are standard throughout the majority of states, offering the same basic benefits regardless of the insurance coverage supplier. There are 10 various Medigap strategies classified A via N, each providing a different degree of coverage. Strategy F is one of the most detailed choices, covering practically all out-of-pocket costs, while other strategies might use a lot more restricted protection at a lower costs.

Recognizing the essentials of Medicare supplements is vital for individuals approaching Medicare eligibility that want to improve their insurance protection and minimize prospective financial burdens related to medical care costs.

Understanding Protection Options

When considering Medicare Supplement plans, it is essential to understand the different insurance coverage alternatives to make certain thorough insurance policy security. Medicare Supplement prepares, also known as Medigap plans, are standard across many states and labeled with letters from A to N, each offering differing degrees of protection - Medicare Supplement plans near me. Additionally, some strategies might use protection for services not consisted of in Original Medicare, such as emergency situation treatment throughout foreign traveling.

Advantages of Supplemental Plans

In addition, additional plans offer a wider array of insurance coverage options, including access to health care service providers that may not accept Medicare job. One more benefit of additional strategies is the ability to travel with tranquility of mind, as some plans provide coverage for emergency medical solutions while abroad. On the whole, the benefits of additional strategies contribute to a much more detailed and tailored method to health go to the website care coverage, guaranteeing that people can obtain the treatment they require without dealing with frustrating economic burdens.

Price Factors To Consider and Savings

Offered the monetary protection and more comprehensive protection alternatives offered by supplemental strategies, an essential element to take into consideration is the price factors to consider and potential cost savings they supply. While Medicare Supplement prepares call for a monthly costs along with the conventional Medicare Component B costs, the advantages of reduced her explanation out-of-pocket expenses commonly exceed the included expense. When assessing the expense of supplemental strategies, it is important to contrast costs, deductibles, copayments, and coinsurance across various plan kinds to identify one of the most cost-efficient alternative based upon private healthcare needs.

Additionally, picking a strategy that aligns with one's wellness and budgetary requirements can result in significant savings over time. By selecting a Medicare Supplement plan that covers a greater percentage of healthcare expenditures, people can decrease unanticipated expenses and spending plan a lot more effectively for healthcare. Additionally, some additional strategies offer family price cuts or incentives for healthy actions, providing further chances for expense financial savings. Medicare Supplement plans near me. Ultimately, buying a Medicare Supplement strategy can supply important economic defense and satisfaction for beneficiaries looking for thorough coverage.

Making the Right Choice

Selecting the most suitable Medicare Supplement plan necessitates mindful factor to consider of specific medical care demands and economic situations. With a selection of strategies readily available, it is critical to analyze variables such as insurance coverage alternatives, premiums, out-of-pocket expenses, supplier networks, and general value. Understanding your existing wellness condition and any type of anticipated clinical demands can assist you in selecting a plan that offers thorough protection for services you might call for. Furthermore, assessing your budget restraints and contrasting premium costs amongst various plans can aid make certain that you choose a plan that is budget friendly in the lengthy term.

Final Thought

Report this page